The Global Mobility Playbook: Strategies for Navigating Risks & Maximizing Rewards

With markets becoming more interconnected than ever, your organization’s ability to successfully move talent, resources, and operations across borders via an effective global mobility strategy is crucial to staying competitive.

In the arena of international business, your organization is like a team vying for the win.

In this game, the players are your employees, each with their own unique skills and potential to score big for the team when positioned in the right place at the right time.

The opposing team is the ever-changing market conditions and the regulatory environments of different countries, presenting both obstacles and opportunities.

Your goal is to execute perfect plays that move your team members across state lines or international borders while avoiding penalties, managing risks, and seizing opportunities.

In other words, your organization needs to be able to respond to market shifts and explore new consumer segments. However, the practice of actually moving employees from point A to B is far from simple.

So, how do decision-makers, like you, in HR, payroll, legal, and other corporate sectors strike a balance between seizing the immense rewards and navigating the intricate challenges of global mobility?

Welcome to your definitive guide: The Global Mobility Playbook!

Whether you’re strategizing talent management across borders or state lines, deciphering the complexities of state-to-state or international taxes, or ensuring that your employees thrive in their new locales, this article has you covered.

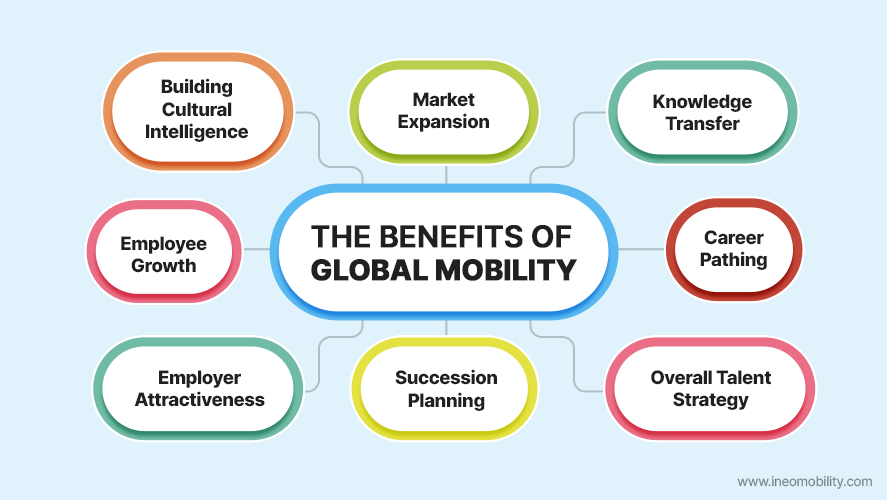

Why Global Mobility?

Despite the amplification of digital interconnectivity, mobility remains the strategic heartbeat of forward-thinking enterprises.

While there are endless reasons why organizations seek to move talent abroad, here are a few of the most common benefits.

Global Expansion: Global mobility allows businesses to explore and penetrate new markets, increasing their reach and revenue streams.

Building Cultural Intelligence: Mobility introduces teams to diverse cultures, fostering a deep understanding and respect for global nuances. This cultural intelligence becomes a prized asset, enabling companies to tailor their strategies to resonate with audiences near or far.

Knowledge Transfer: By moving talent between the home office and the host country, organizations facilitate a seamless exchange of skills, knowledge, and best practices. This transfer enriches both entities, fortifying them with fresh perspectives and innovations.

Talent Development: For the individual, global mobility is a catalyst for both personal and professional growth. Exposure to new environments, challenges, and cultures hones their adaptability, problem-solving skills, and global acumen.

Employer Attractiveness: Companies that embrace global mobility brand themselves as employers of choice. Such an image attracts top-tier talent keen on organizations that offer diverse experiences and growth opportunities.

Succession Planning: Global mobility aids in identifying and nurturing future business leaders. When employers invest in an employee’s relocation/assignment, they provide the employee with a broader experience that leaves them well-equipped to take on pivotal roles when the need arises.

Maximizing the Benefits of Global Mobility

In order to unlock the full potential of global mobility, organizations cannot simply move talent across borders and hope for the best.

The true art lies in maximizing the potential of these global assignments to yield tangible benefits for both your organization and employees.

Here are a few key ways to harness the transformative power of global mobility and turn it into a competitive advantage for your organization.

Comprehensive Training Programs: Before embarking on a global assignment, equip your employees with the tools they need to succeed. This includes cultural training, language classes, insights into local business etiquette, and pre-move tax consulting to help employees mitigate financial risk and headaches down the line.

Robust Technology Infrastructure: In today’s digital age, a seamless technological framework is crucial. Invest in cutting-edge global mobility software that aids in tracking, communication, and overall program efficiency.

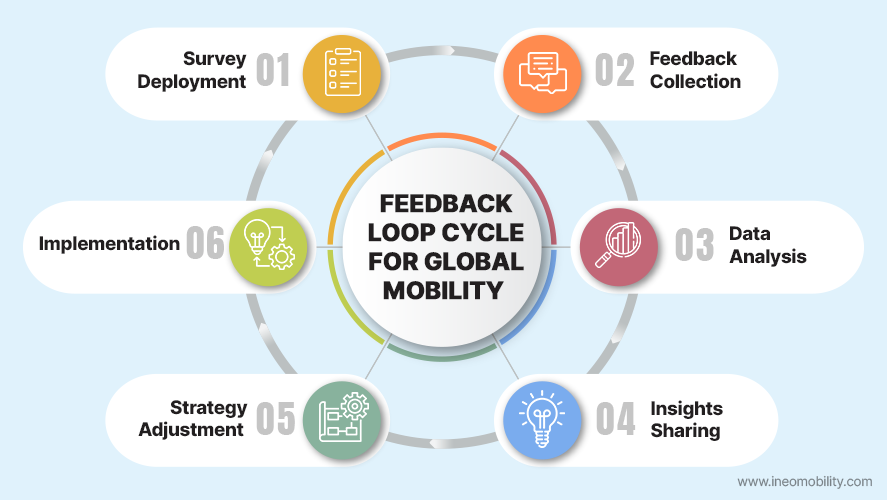

Feedback Mechanisms: Regularly gather feedback from your global workforce. Understand their challenges, celebrate their successes, and iterate on your strategies based on their on-ground experiences.

Partnership with Local Entities: Build strong partnerships with local businesses, governments, and communities. This approach not only aids in smoother operations but also ensures you’re in sync with local nuances and regulations.

Future-proofing: Stay abreast of global trends, economic shifts, geopolitical developments, and potential risk factors. This proactive approach ensures your mobility strategies are always in sync with the global pulse and you are enabled to to fulfill your duty of care in case your mobile employees find themselves in harm’s way.

Inter-departmental Collaboration: Integrate global mobility into the broader organizational fabric by fostering collaboration between departments like recruiting, HR, legal, tax, payroll, legal, and procurement. This unified approach ensures smoother transitions, comprehensive support, and more informed decision-making. Ineo’s Ineovate Global Mobility: Tax Legal & Payroll Webinar is a great place to start with valuable information on a wide array of mobility-related topics.

However, ensuring a successful global mobility program goes beyond just maximizing the benefits. Global mobility also poses a variety of risks that organizations must identify and overcome to realize the true value that global mobility provides.

In the following sections, we dive into some of the most pressing risks that your organization might face and how to overcome them.

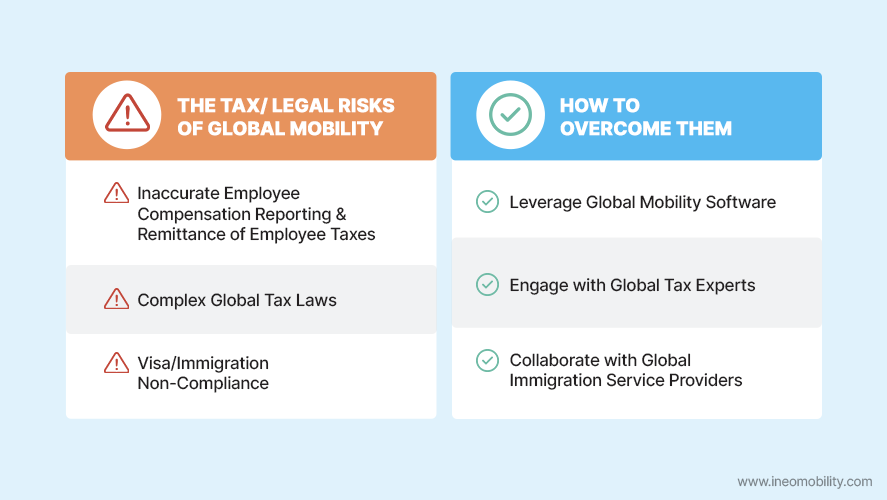

Overcoming the Tax/Legal Risks of Global Mobility

Navigating the intricate web of global mobility comes with its fair share of mobility tax and legal challenges. These challenges, if not addressed proactively, can lead to significant financial and reputational risks for both your company and international employees.

Let’s delve deeper into understanding these risks and the strategies to mitigate them.

What are the Tax/Legal Risks?

Complex Global Tax Laws – For Both the Company and the Employee

If your operations span multiple countries or states, your organization must ensure compliance with a myriad of tax laws. This tax compliance is not just at the corporate level but extends to employees who may be subject to different tax obligations based on their assignments.

Likewise, navigating the tax landscape of multinational or multi-state operations is complicated. Each country, state, or jurisdiction has its unique set of tax rules and regulations, often varying in rates, deductions, and filing requirements.

So what are the risks associated with non-compliance?

Beyond the immediate financial implications, such as penalties from incorrect filings or withholdings, there’s a significant reputational risk. In today’s age of heightened corporate scrutiny, any misstep, even if unintentional, can tarnish a company’s image and hinder its future mobility-related opportunities. Non-compliance may even lead to potential rejection by countries or states when seeking to expand your business in those regions.

Employee Compensation Reporting and Remittance of Employee Taxes

Accurate reporting of employee compensation, which includes not just basic salary but also bonuses, benefits, and other remunerations, is essential for tax compliance.

Companies that overlook this crucial aspect risk facing substantial fines and potential legal actions. Inaccurate reporting, whether intentional or not, can be perceived as tax evasion.

Additionally, non-compliant companies might also find themselves under increased scrutiny from tax authorities in the future, leading to more frequent audits and added administrative burdens.

Moreover, employees themselves can be blindsided by unexpected tax bills if their compensation details are misreported or omitted.

Moreover, rectifying such errors can be an operational nightmare, consuming significant time and resources.

Employee Travel/Workdays and Visa/Immigration Compliance

Monitoring employee travel and workdays is a critically important task when sending employees on relocation/assignment.

The number of days an employee spends in a particular country can have tax implications, potentially leading to issues of double taxation or tax law violations.

And, beyond tax implications, a misstep, such as an employee overstaying or working in a foreign country without the appropriate documentation, can lead to dire consequences, including legal penalties, deportation, or even bans on future travel to that country.

Furthermore, repeated immigration infractions can complicate future visa and permit applications, as authorities might subject your company to increased scrutiny.

How to Overcome Tax/Legal Risks

While these risks can be daunting, don’t let them deter your organization from pursuing a global mobility program. Here are a few ways that you can mitigate the tax and legal risks above.

Engage with Global Tax Experts

One of the most effective ways to navigate the complex world of global tax laws is to work with experts who have a deep understanding of these regulations!

For example, Ineo’s team of global tax experts can provide trusted guidance, ensuring that both your company and employees remain compliant.

Leverage Global Mobility Software

The Ineo Platform is a state-of-the-art software solution designed to accumulate and report employee compensation data. It ensures that all relevant data is captured accurately and reported to the necessary entities in a timely manner.

For companies that prefer to outsource this responsibility, we also offer services that utilize our software to ensure compliant reporting.

Collaborate with Global Immigration Service Providers

Collaborating with global immigration service providers offers organizations specialized expertise in navigating the complex tax laws associated with international assignments.

These providers can keep your organization informed about changes in tax legislation, assist in risk assessment, and liaise with tax authorities to mitigate potential liabilities.

Overcoming Financial Risks

In addition to the financial risks of non-compliance with global tax laws, global mobility also poses additional risks that could significantly impact your organization’s bottom line.

These risks, if not anticipated and managed proactively, can lead to unforeseen expenses and challenges that might hinder the success of your global mobility program.

What are the Financial Risks?

Unforeseen Expenses

Emergencies in the realm of global mobility can arise without warning and have the potential to strain an organization’s budget significantly.

Sudden repatriations, for instance, may be necessary due to geopolitical unrest, natural disasters, or personal emergencies, leading to unplanned travel and resettlement expenses.

Additionally, unexpected health-related costs can emerge, especially in regions where medical care is expensive or if specialized treatment is required.

Beyond these expenses, employees might encounter unique challenges in their new environments, from cultural adjustments to navigating local business practices. Addressing these challenges might require additional training, resources, or on-ground support, further adding to the unforeseen expenses.

Currency Fluctuations

Operating in multiple countries means dealing with a variety of currencies, each with its own value and rate of exchange. This exposure to multiple currencies brings organizations face-to-face with the unpredictable nature of foreign exchange rates.

Even minor shifts in exchange rates can translate to significant cost variations, especially for large transactions or long-term assignments.

Improper Budgeting

A successful global assignment hinges on meticulous planning and budgeting, ensuring that every potential expense is accounted for.

Without enough foresight, organizations can easily overlook or underestimate certain costs associated with international assignments. These costs can range from housing and schooling allowances to cultural integration training and local transportation.

Allocating insufficient funds can lead to financial shortfalls, which not only disrupt the ongoing assignment but can also impact the overall success and morale of the assigned employee.

Supply Chain Misalignment

When relocating employees internationally, a lack of coordination in the supply chain, particularly in the temporary housing and household goods transportation spaces, can result in an additional financial burden.

For instance, miscommunications in housing arrangements can result in extended hotel stays, while logistical errors in goods transportation can lead to additional storage fees or replacement costs for damaged items.

These unforeseen expenses, stemming from supply chain issues, can quickly escalate, straining the allocated budget for an assignment, compounded by the indirect costs of reduced employee productivity and satisfaction.

Academic Parity Issues

Ensuring that employees’ dependents have access to consistent educational opportunities while abroad is complicated.

The complexity arises from the need to match or exceed the educational standards that dependents were receiving in their home country or state. If out of the country, this need often means enrolling them in international schools that offer a comparable curriculum, which can come with high tuition fees.

These costs can escalate quickly, especially if there are multiple dependents or if the assignment is in a location where the demand for international schooling exceeds the supply, driving up prices.

Moreover, the administrative burden of securing spots in reputable schools, dealing with waiting lists, and ensuring the continuity of education through different postings adds layers of complexity that require careful planning and significant investment.

This burden should not fall on the shoulders of the employee as it is important that their focus remains on their new role upon relocating.

Cost of Living Differential

Variations in living costs between an employee’s home country and the host country can have a substantial impact on the financial aspects of a global mobility program.

When employees are sent to locations where the cost of living is higher, they may require additional compensation to maintain their standard of living. This requirement could include allowances for housing, which can be considerably more expensive in the host country, as well as for daily necessities such as food, transportation, and schooling for children.

Failure to accurately adjust compensation and allowances can lead to dissatisfaction, decreased productivity, or even the premature return of the employee, all of which can incur additional costs and undermine the success of international assignments.

How to Overcome Financial Risks

Leverage Global Mobility Software

Global Mobility software can be especially beneficial for managing the financial complexities of international assignments.

By using such software, organizations can access historical data from past relocations and assignments, which serves as a valuable benchmark for future budgeting.

Furthermore, advanced global mobility software often includes tools that can forecast currency fluctuations, a critical feature for companies operating in multiple countries. This capability allows for proactive adjustments to compensation packages and budgets, safeguarding against the financial unpredictability that can accompany changes in exchange rates.

By incorporating these forecasts into financial planning, organizations can create a buffer against potential losses due to adverse currency movements and ensure that global mobility programs remain financially viable and predictable, even in the face of market volatility.

Another great tool that can help mitigate financial risks is an expense-tracking and reporting app for mobile employees to track their on-the-move costs. Ineo’s mobile app, Voyager Assistant, is a great option. This app allows companies to set applicable expenses based on the company’s global mobility policy so employees know exactly what they can and cannot expense.

Review Your Supply Chain Annually

Conducting an annual supply chain review is a critical exercise for organizations engaged in global mobility, as it allows you to analyze and evaluate the efficiency of the processes and supplier partners involved in relocating employees.

For instance, you might find that consolidating shipments of household goods could reduce transportation costs, or that negotiating more favorable terms with housing providers could lower accommodation expenses.

Additionally, this review process can reveal opportunities for bulk purchasing or long-term contracts that could lead to significant savings.

Impose More SLA Penalties in Supplier Contracts

The incorporation of Service Level Agreement (SLA) penalties into contracts with suppliers is a strategic approach that enforces high-performance standards and ensures value for money in global mobility programs.

By establishing clear penalties for underperformance, organizations incentivize their supplier partners to adhere to agreed-upon timelines, quality levels, and cost parameters.

This contractual mechanism serves as a safeguard against subpar service that could lead to increased costs, such as those arising from delayed relocations, extended temporary housing stays, or mishandled shipments of household goods.

SOS Services For Evacuation Out of a Country

SOS Services, or emergency evacuation arrangements, are a critical component of risk management in global mobility, designed to provide swift support in crisis situations.

These services are not just a safety net for employees in volatile regions but also a financial safeguard for the organization.

By having proactive arrangements in place, companies can ensure that they can quickly and efficiently repatriate employees and their families in the event of political unrest, natural disasters, health epidemics, or other emergencies. This readiness can significantly reduce the potential costs associated with last-minute evacuations, which can be exorbitant when arranged independently and under pressure.

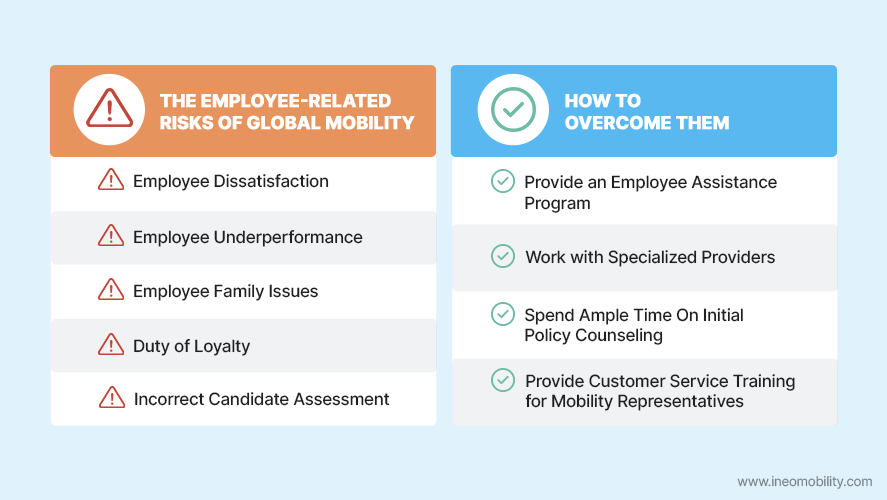

Overcoming Employee-Related Risks

Last but not least—employee-related risks.

Employees are the lifeblood of your organization. Keeping them happy and performing at their best is essential to the success of your global operations.

What are the Employee-Related Risks?

Employee Dissatisfaction & Turnover

Unfortunately, the upheaval of an assignment can sometimes lead to employee dissatisfaction and attrition.

This not only results in the loss of the considerable investment made in the employee’s selection, training, and relocation but also erodes your accumulated human capital and disrupts ongoing projects.

This turnover can have a ripple effect, deterring other potential candidates from mobile roles and impeding your organization from maintaining a robust global presence, ultimately affecting your competitive edge in the marketplace.

There are several potential causes of dissatisfaction throughout the employee relocation process:

- An unhappy family transition.

- An unsuccessful home-selling/home-finding process.

- An unsuccessful settling-in process.

- Unsuccessful supplier partners and their services (ex. delayed household goods shipping).

- An undesirable host location due to culture shock, or a high-stress, and/or politically abrasive environment.

- The expectations of the job role did not meet the employee’s perception of opportunity.

- The employer may not be satisfied with the employee’s work/success on assignment.

- Compliance issues landing on the employee.

- The tedious tasks associated with the assignment landing on the employee (home finding/home selling process, seeking education for dependents, Visa and Immigration requirements, etc.).

- Damage or delay during household goods transportation.

- Lack of quality control in temporary housing.

Employee Underperformance

Performance issues stemming from an employee’s inability to adapt to a new country or business environment represent a significant risk in global mobility.

When an employee is relocated, they are often expected to hit the ground running, despite facing a host of unfamiliar challenges. These challenges can range from navigating different workplace norms and expectations to overcoming language barriers and understanding local market dynamics.

If an employee is unable to quickly assimilate, their effectiveness in the role can be compromised.

For the organization, this risk translates into several consequences.

- There’s the potential for lost productivity, missed business opportunities, and the need for additional training or support resources.

- An underperforming employee can also affect team morale, strain client relationships, and tarnish the organization’s reputation in the new market.

- Moreover, if the employee is in a leadership position, their struggle to adapt can have cascading effects on the performance of their team or department, potentially undermining the success of the entire local operation.

Employee Family Issues

When it comes to the success of an international assignment, it’s equally important for an employee’s family to be able to adapt to their new location. Challenges faced by family members, such as cultural adaptation, social setbacks or finding appropriate schooling, can distract an employee and impact their work performance.

For the organization, this can translate into decreased productivity, potential early termination of an assignment, and the associated financial and operational costs of repatriation or reassignment.

Duty of Loyalty

In the context of international assignments, the duty of loyalty is a critical factor because the employee is often entrusted with significant responsibilities that may include handling sensitive information, managing substantial budgets, or negotiating on behalf of the company in foreign markets.

The risk to international assignments arises when global employees feel disconnected from their company and colleagues due to physical distance, cultural differences, or a lack of support.

Such disconnection can lead to a weakened sense of allegiance and a diminished duty of loyalty. Employees may feel less compelled to prioritize the company’s interests, which can manifest in various ways, from reduced diligence in their work to the extreme of divulging confidential information or engaging in activities that benefit competitors or their own interests.

Incorrect Candidate Assessment

An incorrect assessment of a candidate’s suitability for an assignment/relocation can lead to significant challenges. This situation not only undermines the success of the assignment/relocation but also incurs financial costs due to potential early termination, the subsequent need to find a replacement or overall assignment/relocation failure.

Moreover, it can damage the company’s local and global reputation if the employee fails to integrate effectively with the host location’s culture and business practices.

How to Overcome Employee-Related Risks

Provide an Employee Assistance Program

Employee Assistance Programs (EAPs) serve as a pivotal support mechanism for employees undergoing the stresses of international assignments, offering a suite of services that address both mental health concerns and practical adjustment challenges.

By providing confidential counseling and assistance with relocation logistics, such as housing and schooling, EAPs help mobile employees and their families acclimate to new environments more smoothly, thereby enhancing their overall well-being, job satisfaction, and productivity.

Work with Specialized Providers

Working with providers that address employee pain points of global mobility, such as a global mobility software provider or a destination services company, can improve employee satisfaction, morale, and productivity.

Global mobility software streamlines the complex administrative processes associated with international relocation, ensuring compliance and reducing the risk of errors that can lead to employee frustration.

Meanwhile, destination services offer crucial on-the-ground support, helping employees and their families find housing and schools, and integrate into their new community, which can significantly ease the emotional and logistical challenges of moving abroad.

Together, these specialized services can transform a potentially stressful transition into a positive experience, enhancing the employee’s engagement and enabling them to contribute effectively in their new role from the start.

Spend Ample Time on Initial Policy Counseling

Engaging employees in comprehensive policy counseling before an assignment/relocation is essential for setting realistic expectations and ensuring a smooth transition.

This detailed briefing should cover all aspects of the company’s global mobility policies, from logistics to support services, allowing employees to fully understand their benefits, responsibilities, and the resources available to them.

Such proactive communication not only prepares employees for upcoming changes but also minimizes misunderstandings and fosters a sense of security and support, paving the way for successful integration into their new role and environment.

Provide Customer Service Training for Mobility Representatives

Providing training for your global mobility team enhances their ability to offer empathetic and effective support, improving the mobility experience for assignees or transferees.

With this training, mobility representatives can better understand and anticipate the challenges that employees might face, from cultural shock to logistical hurdles, and provide timely and appropriate solutions to increase talent retention.

They become adept at communicating clearly and supportively, which can significantly alleviate the stress and anxiety that employees and their families often experience during such transitions.

Ineo’s Ineovate Global Mobility: Tax, Legal & Payroll Webinar is a great place to start training staff of customer service best practices.

The Key to Maximizing the Rewards & Mitigating the Risks of Global Mobility

In conclusion, a successful global mobility strategy requires an intricate balance—balancing compliance with agility, costs with benefits, and employee needs with organizational goals.

Ineo’s comprehensive all-in-one global mobility platform, having facilitated over a million assignments, stands at the forefront of this industry. We invite you to schedule a demo to explore how our platform can transform and streamline your global assignments and operations and become a key player in your global mobility playbook.

Global Mobility Resources

Learn more about what’s going on at Ineo and insights into the complex world of global mobility from the industry’s top thought leaders and innovators.

Request A Demo

Whether you are new to the world of global mobility or you’ve been in the business for a while, Ineo is here to assist you.

The best way to learn how Ineo’s global mobility software can help your company revolutionize your global mobility program and support your business strategy is to see it in a demo.

Fill out this form to get started today.

Get Started